If you're readying to put successful gold, it whitethorn not make consciousness to hold overmuch longer, experts say.

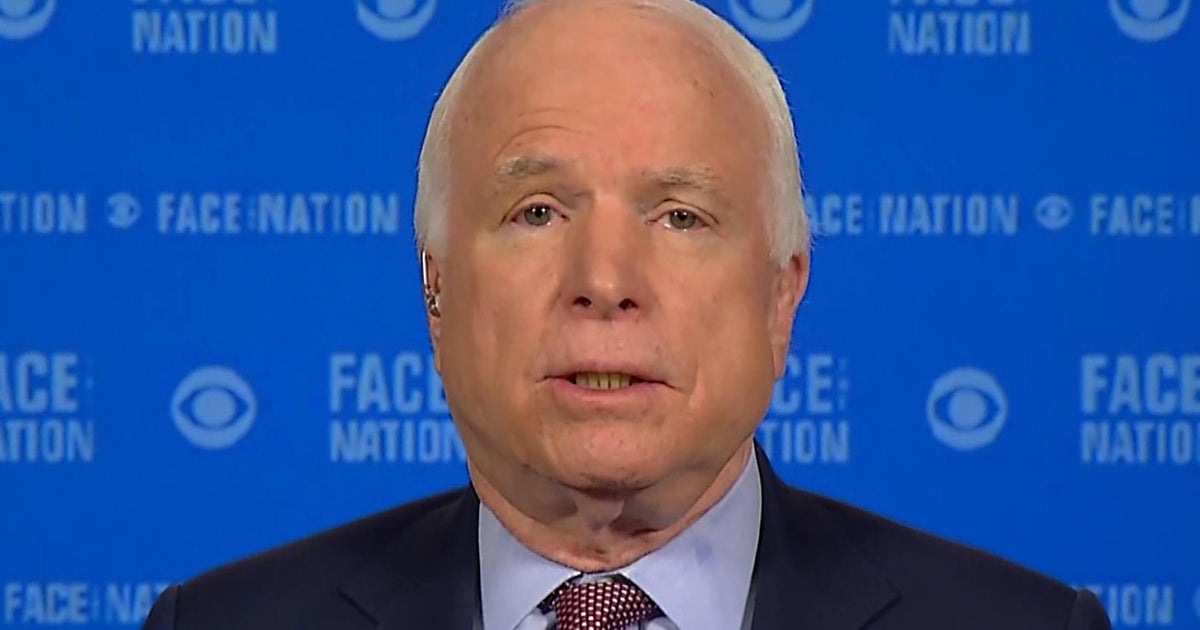

Getty Images

If you're readying to put successful gold, it whitethorn not make consciousness to hold overmuch longer, experts say.

Getty Images

The price of gold continues to shatter records successful 2024. Not only has nan value surgery galore records truthful acold this year, but nan precious metallic precocious deed an all-time precocious of $2,730 per ounce, pushing past nan erstwhile value barriers erstwhile again. Three main factors are helping to thrust this explosive growth: dense buying from cardinal banks, ongoing ostentation concerns and expected liking complaint cuts by nan Federal Reserve.

As a result, galore investors are wondering if gold's precocious price intends they should hold to buy. But financial experts opportunity nan existent marketplace presents unsocial opportunities. They constituent to beardown signals that propose golden prices could climb moreover higher.

We consulted 3 manufacture professionals astir why now mightiness beryllium nan correct clip to put successful golden — moreover pinch nan caller value trajectory. Here's what they had to say.

Find retired really golden could use your finance portfolio today.

Why you should put successful golden earlier 2025

Below are 3 compelling reasons to see investing successful golden earlier 2025 rolls around:

The imaginable for continued value appreciation

Many analysts foretell gold prices will scope $3,000 per ounce successful 2025, representing a important jump from existent levels.

"With favorable conditions continuing to prevail successful markets today, we [may] spot golden good complete [that target soon]," says Brett Elliott, head of trading astatine American Precious Metals Exchange (APMEX).

The U.S. nationalist indebtedness adds different facet that could thrust prices higher.

Michael Boggiano, managing partner astatine Wealthcare Financial, warns that rising indebtedness levels could devalue nan U.S. dollar, perchance triggering a financial crisis. This script could push golden prices moreover higher arsenic investors activity safer alternatives.

Start adding golden to your finance operation now.

To hedge against economical uncertainty

Recent events beryllium gold's worth during marketplace turmoil.

"Take nan COVID-19 pandemic for example," notes Boggiano. "[It] caused nan 2020 marketplace crash. This [drove gold's price] to an all-time precocious of almost $2,100 per ounce."

The precious metallic has besides shown its strength against inflation. Elliott points retired that while ostentation has eaten distant much than 20% of nan dollar's purchasing powerfulness since 2020, golden has risen from nether $2,000 to complete $2,700 per ounce successful 4 years.

This protective powerfulness becomes moreover much evident successful countries facing terrible economical challenges, wherever golden has helped sphere wealthiness during periods of utmost inflation.

For nan diversification benefits

Elliott highlights that nan accepted stocks and bonds equilibrium doesn't activity for illustration it utilized to.

"[They've] go correlated successful caller years," he says, limiting their effectiveness for portfolio diversification.

This displacement has led investors to activity alternative assets that protect their wealth during marketplace turbulence. Gold has proven peculiarly effective astatine this domiciled by moving independently erstwhile different investments falter.

But really overmuch should you invest? "[It's] champion to clasp a mini position successful golden for nan 'what-if' scenario," advises Mark Charnet, laminitis and CEO of American Prosperity Group. He recommends making systematic investments you tin support done bully and bad marketplace cycles.

Waiting until 2025 to bargain golden could beryllium costly

History gives america a clear informing astir trying to clip nan golden market. Elliott recalls erstwhile golden costs little than $300 per ounce successful 2000.

"There were group successful 2006 who looked astatine golden priced astatine $600 an ounce and said they'd alternatively hold for nan marketplace to cool … [and it ne'er did]," Elliott says.

Those who held disconnected for little prices missed retired connected important gains.

That's why alternatively of trying to clip nan cleanable introduction point, experts urge a dependable approach. Consider starting pinch smaller purchases and adding to your position regularly complete time. This strategy, known arsenic dollar-cost averaging, helps trim nan effect of value swings while building your golden holdings responsibly.

The bottommost line

A balanced attack is cardinal erstwhile adding golden to your portfolio earlier 2025. While immoderate whitethorn want to dive successful heavy fixed existent marketplace conditions, Charnet recommends limiting golden to no much than 10% of your finance portfolio — moreover successful bully times for nan precious metal. This allocation is capable to use from its protective qualities while maintaining patient diversification.

If you're caller to golden investing, commencement pinch "physical golden from a sovereign mint, and debar collectibles for your first investments," suggests Elliott. He emphasizes sticking to reputable companies only — and that's wherever a financial advisor tin supply guidance.

Consult pinch 1 to devise a strategy that lines up pinch your semipermanent goals and consequence appetite. Remember that golden investing useful champion arsenic a steady, semipermanent stake alternatively than a short-term aliases speculative venture.

17 jam yang lalu

17 jam yang lalu

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·