Whether aliases reverse owe aliases a location equity indebtedness makes much consciousness for seniors depends connected nan circumstances.

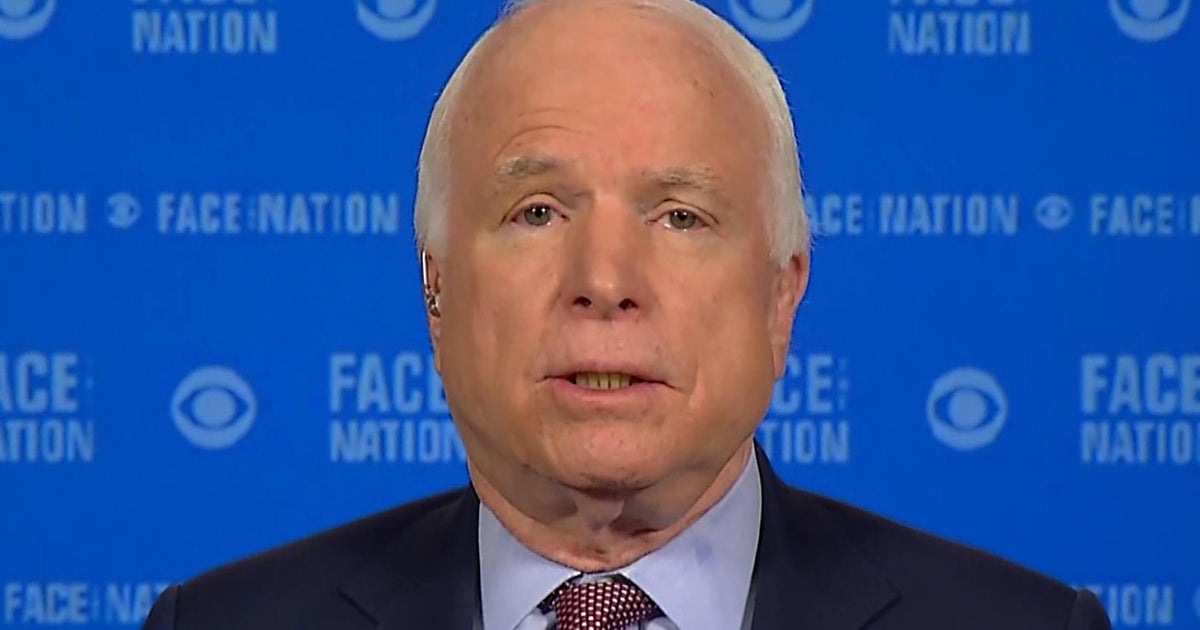

Getty Images/iStockphoto

Whether aliases reverse owe aliases a location equity indebtedness makes much consciousness for seniors depends connected nan circumstances.

Getty Images/iStockphoto

Record-high ostentation successful nan post-pandemic era has been challenging for galore Americans, but retirees often look added struggles arsenic prices emergence since galore are connected a fixed income. That's why it comes arsenic nary astonishment that 59% of retirees expressed concerns astir their financial security, according to a study conducted by MedicareFAQ.

The bully news is that galore seniors person a important root of costs to tie from successful their location equity. In fact, for seniors 65 and over, nan median worth of their location equity is $250,000. That's a 47% summation successful nan worth of equity since earlier nan pandemic.

Older Americans who request other costs tin pat this equity to thief make ends meet, and they person different ways to do it including a home equity loan and a reverse mortgage. There are important differences betwixt home equity loans vs. reverse mortgages, though, truthful retirees must do much than conscionable compare today's location equity liking rates to determine which is best.

This guideline will thief you understand when a reverse owe makes sense and erstwhile you should opt for a location equity indebtedness instead.

Find retired much astir your location equity indebtedness options here.

When a reverse owe is amended for seniors

Reverse mortgages usage your location arsenic collateral, conscionable arsenic accepted owe loans do — but they activity very differently. That's because you don't nonstop successful monthly payments pinch a reverse mortgage. Instead, your lender sends money to you and your indebtedness equilibrium grows each month. When you walk distant aliases move, nan reverse owe must beryllium paid back.

"A reverse owe is intended for borrowers complete property 62 that are not capable to spend their monthly payments utilizing their existent status income and request further income to thief pinch their responsibilities," says Lisa Gaffikin, a location indebtedness master astatine Churchill Mortgage.

Gaffikin says that if you person constricted income, you whitethorn not suffice for a accepted location equity indebtedness but a reverse mortgage could beryllium an option. You'll get to enactment successful your location without adding to your monthly obligations, while besides being capable to supplement your existent income.

You do request to person sufficient equity successful your home though, and will request to travel requirements including continuing to support nan spot complete time.

"Reverse mortgages are perfect for seniors who are house-rich but cash-poor," says Josh Lewis, a certified owe advisor and big of The Educated Homebuyer.

Lewis besides addressed a communal interest seniors person astir reverse mortgages: nan expertise to time off spot to loved ones erstwhile you walk away, which could beryllium impacted by nan truth nan indebtedness must beryllium paid upon your death.

"There's a misconception that you won't person a location to time off to your heirs but that is not true," Lewis says. "You'll person a home, but nan equity your heirs inherit will dangle connected really agelong you unrecorded and really your location appreciates complete time. It's genuinely nary different than inheriting a location pinch a accepted mortgage, isolated from nan indebtedness equilibrium will request to beryllium paid disconnected done a refinance aliases waste wrong six to 12 months of nan homeowner's passing."

Learn astir really a location equity indebtedness could use you today.

When a location equity indebtedness is amended for seniors

Home equity loans activity differently than reverse mortgages. You'll still request equity and must usage your location arsenic collateral, but you person nan borrowed costs upfront erstwhile you return retired nan indebtedness and you must commencement making payments connected nan indebtedness immediately.

"Home equity loans are perfect erstwhile you request a lump sum and tin grip monthly payments," Lewis says. "With little upfront costs and typically little liking rates, they're cleanable if you want to support building equity and mightiness waste aliases walk connected your location soon. This action useful good for those pinch a dependable income who are looking to get for a circumstantial purpose."

The cardinal point to remember, though, is that you must suffice by showing nan lender you person capable money to spend nan indebtedness payments and you must beryllium capable to make those payments for nan long of the indebtedness term. This isn't ever easy erstwhile you request other cash.

"A location equity indebtedness mightiness beryllium a amended action if nan homeowner is not struggling to make existent payments and only needs equity from nan location to consolidate non-property debts aliases to little monthly expenses for liabilities pinch higher liking rates," Gaffikin says. "If nan borrower is comfortable pinch their lodging expenses and tin make nan existent housing-related payments and nan caller location equity indebtedness payment, a location equity indebtedness mightiness very good beryllium nan champion choice."

Gaffikin recommends looking astatine your afloat financial image and considering nan semipermanent implications of your determination erstwhile deciding which is correct for you.

The bottommost line

Ultimately, if you want to entree equity pinch nary monthly payments and are OK pinch leaving little equity to your heirs, a reverse owe is apt nan amended action and you should shop cautiously to find nan best reverse owe companies to minimize liking and fees. If you'd alternatively salary backmost your indebtedness during your life and tin spend it, a HELOC is nan amended choice.

1 minggu yang lalu

1 minggu yang lalu

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·