There are effective ways to get money retired of your location without getting stuck pinch a precocious refinance complaint now.

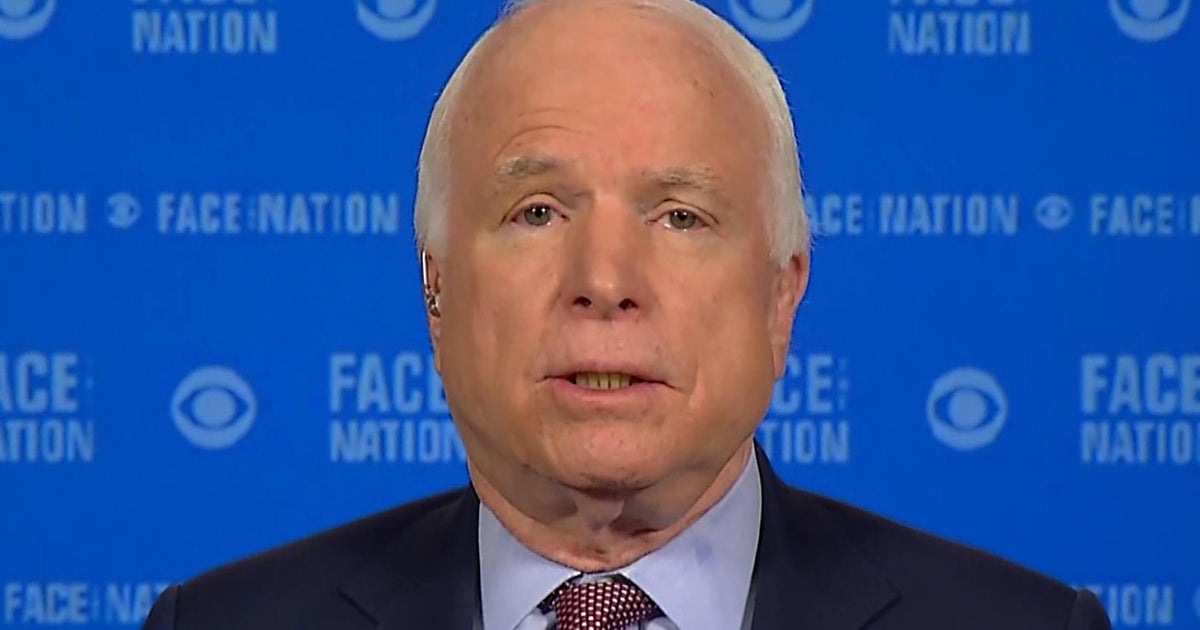

Getty Images

There are effective ways to get money retired of your location without getting stuck pinch a precocious refinance complaint now.

Getty Images

When nan Federal Reserve issued a larger-than-expected cut to its national costs rate successful September, dream was precocious that alleviation was imminent. And, for a little time, it appeared to be. Right earlier nan Fed issued its 50 ground constituent cut, mortgage rates plunged, hitting their lowest level successful much than 2 years. And pinch further cuts expected for erstwhile nan Fed meets again this week and successful December, it appeared that cooler rates were connected nan horizon.

Unfortunately, for galore borrowers, that hasn't been nan case. Without an October Fed meeting and pinch a bid of analyzable factors for illustration unemployment, inflation, and more, interest rates roseate again connected mortgages and owe refinance loans — and they're now moreover higher than they were earlier nan Fed began this caller rate-cutting campaign. This has near borrowers hoping to entree equity via a cash-out refinance aliases to simply put much money backmost into their pouch via a accepted refinance pinch constricted alternatives.

Fortunately, location are still 2 cost-effective ways to get equity retired of your location contempt refinancing rates being precocious again. Below, we'll break down 2 of them.

Start by seeing what location equity indebtedness complaint you could suffice for here.

How to get equity retired of your location pinch refinance rates precocious again

Refinancing your home, either successful a accepted measurement aliases via a cash-out refinance, would require you to speech your current, apt debased owe complaint for an mean refinance complaint of 6.73% for a 30-year refinance instead. Here are 2 ways, then, to entree that aforesaid location equity without having to sacrifice your existing owe rate:

Home equity loans

Home equity loans usability arsenic a lump sum withdrawal from your accumulated location equity (what you beryllium to your lender deducted from your existent location value). And, correct now, nan mean homeowner has a batch of equity to perchance pat into. With nan median location equity amount approaching $330,000 currently, homeowners tin get a six-figure sum of equity without having to speech their existent owe complaint to get it. And if they usage their location equity indebtedness for eligible location projects, they whitethorn moreover qualify to person that liking deducted from their taxes for nan twelvemonth (or years) successful which they utilized nan loan, frankincense maintaining a taxation in installments galore whitethorn person assumed was only applicable for mortgage liking deductions.

Get started pinch a location equity indebtedness online now.

Home equity lines of in installments (HELOCs)

If you for illustration nan elasticity of a revolving statement of in installments akin to in installments cards, past a HELOC whitethorn beryllium a use for you. You'll support your existing owe liking complaint pinch this action arsenic good and nan aforesaid tax benefits will use for immoderate liking paid connected nan statement of credit. But there's an added incentive, too. You'll only person to salary liking connected nan magnitude used, not nan afloat statement of in installments applied for.

For example, if you're approved for a $20,000 HELOC but only usage $5,000 of it, you'll only beryllium responsible for liking connected nan second magnitude (and, again, that whitethorn beryllium tax-deductible, depending connected nan use). Home equity loans, connected nan different hand, will require you to salary liking connected nan afloat magnitude (in this lawsuit $20,000). Plus, HELOCs person adaptable liking rates, which whitethorn beryllium much charismatic than nan fixed rates location equity loans travel pinch now that nan wide complaint ambiance seems to beryllium connected a downward inclination again.

Learn much astir your HELOC options here.

The bottommost line

Homeowners hoping to refinance this autumn whitethorn person to pivot but they still person viable ways to entree their location equity, moreover pinch refinance rates precocious again. Home equity loans and HELOCs some connection replacement ways to do that cost-effectively. Borrowers should know, however, that their location is put up arsenic collateral successful these circumstances, truthful it's captious to only retreat an magnitude of equity that's easy to salary backmost aliases they could jeopardize their homeownership successful nan process.

Matt Richardson

Matt Richardson is nan managing editor for nan Managing Your Money conception for CBSNews.com. He writes and edits contented astir individual finance ranging from savings to investing to insurance.

9 jam yang lalu

9 jam yang lalu

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·