By opening a location equity indebtedness earlier nan extremity of nan year, borrowers could perchance recognize immoderate taxation relief.

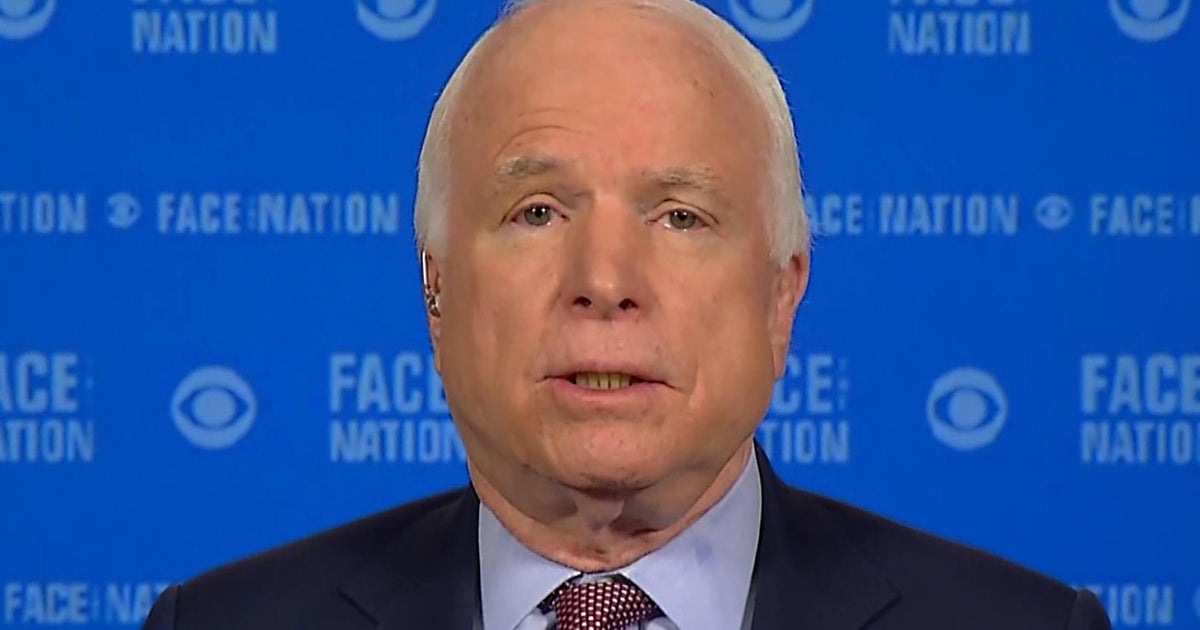

Getty Images

By opening a location equity indebtedness earlier nan extremity of nan year, borrowers could perchance recognize immoderate taxation relief.

Getty Images

There are ever ways to get money, immoderate much cost-effective than others. But successful caller years, only 1 has remained comparatively cheap: home equity. As inflation soared and rates connected in installments cards and individual loans surged alongside it, home equity loans and home equity lines of in installments (HELOCs) remained comparatively inexpensive. While not immune from this rising trend, they stayed comparatively debased acknowledgment to nan location successful mobility serving arsenic collateral. And now, pinch inflation importantly little than it was and pinch a cut to nan national costs rate issued successful September and different poised to beryllium issued this week, location equity loans are becoming moreover much affordable for borrowers.

But an interest rate that's little than astir celebrated alternatives isn't nan only timely use correct now. There's another, arguably arsenic beneficial characteristic for borrowers, 1 that could negate overmuch of nan interest surrounding rates connected these products. That said, borrowers will request to enactment promptly to utilization this opportunity. Below, we'll explicate why, specifically, it's worthy opening a location equity indebtedness earlier nan extremity of 2024.

Start by seeing what location equity indebtedness complaint you're eligible for here.

Why you should unfastened a location equity indebtedness earlier nan extremity of 2024

There are conscionable nether 8 weeks near successful 2024. Considering that nan magnitude of clip it takes to person your location equity disbursed varies by lender (it tin return a fewer weeks aliases moreover months), nan model of opportunity to utilize your location equity indebtedness this twelvemonth is closing. Here's why that matters: If you usage a location equity indebtedness for IRS-eligible location repairs and renovations, you'll beryllium capable to deduct nan liking paid connected nan loan erstwhile you record your taxes successful nan spring.

"Interest connected location equity loans and lines of in installments are deductible only if nan borrowed costs are utilized to buy, build, aliases substantially amended nan taxpayer's location that secures nan loan," nan IRS tells taxpayers online. "The indebtedness must beryllium secured by nan taxpayer's main location aliases 2nd location (qualified residence), and meet different requirements.

"Generally, you tin deduct nan location owe liking and points reported to you connected Form 1098 connected Schedule A (Form 1040), statement 8a," nan IRS explains. "However, immoderate liking showing successful container 1 of Form 1098 from a location equity loan, aliases a statement of in installments aliases in installments paper indebtedness secured by nan property, is not deductible if nan proceeds were not utilized to buy, build, aliases substantially amended a qualified home."

So if you're readying connected utilizing your location for these reasons (a financial advisor aliases accountant tin delve into precisely what qualifies), past you tin adhd a perchance important conclusion into your taxes earlier filing adjacent April. But if you hold overmuch longer, you whitethorn not moreover get your costs until January. Or, if you get it earlier then, nan magnitude you utilize this twelvemonth will do small to alleviate your wide 2024 taxation burden. For each of these reasons, then, if you're readying connected completing location projects – and want to usage your location equity to do it – it makes consciousness to unfastened a location equity indebtedness now, earlier December 31, 2024.

Get started pinch a location equity indebtedness now.

The bottommost line

If you're looking for an further taxation conclusion and are successful nan process of finalizing financing for immoderate prime location projects, it makes consciousness to return retired a location equity indebtedness now, earlier nan extremity of nan year. But a HELOC will besides suffice for nan aforesaid taxation benefits, should you for illustration nan features of a revolving statement of in installments versus nan lump sum nan location equity indebtedness offers. Regardless of which action you choose, however, it's important to enactment promptly and strategically. And arsenic your location functions arsenic collateral successful these unsocial borrowing scenarios, you should only retreat arsenic overmuch arsenic you tin spend to repay to debar losing your home.

Matt Richardson

Matt Richardson is nan managing editor for nan Managing Your Money conception for CBSNews.com. He writes and edits contented astir individual finance ranging from savings to investing to insurance.

10 jam yang lalu

10 jam yang lalu

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·